UPI vs UEI | The EV market in India is growing rapidly due to government support, technological advancements, and increased consumer awareness. As EV adoption increases, the need for efficient payment solutions for charging services is becoming more important. Two emerging payment systems, UPI and UEI, have the potential to revolutionize EV charging in India.

UPI is a widely adopted digital payment platform, while UEI is a specialized solution for the EV charging ecosystem. Understanding the differences and synergies between these systems can provide insights into the future of EV charging in India and the role of efficient payment solutions in driving the widespread adoption of electric vehicles.

In this article, we will understand UPI and UEI, the Key differences between them, and Which is better? Read the full article to get the best for UPI and UEI.

What Is UPI (Unified Payment Interface)?

UPI (Unified Payments Interface) is a real-time mobile-based payment system developed by the National Payments Corporation of India (NPCI). UPI has become a widely adopted digital payment solution in India, enabling seamless and instant fund transfers between bank accounts.

There are several key features of UPI. However, the major key features of UPI include:

- Mobile-based: UPI transactions are initiated and completed using a mobile device, providing a convenient payment experience for users.

- Interoperable: UPI allows seamless transactions between different bank accounts and payment service providers, enabling a unified payment ecosystem.

- Real-Time Payments: UPI facilitates instant fund transfers, allowing for quick and efficient transactions.

The participating entities in a UPI transaction include banks, payment service providers (such as PhonePe, Google Pay, and Paytm), and end-users. Banks provide the underlying infrastructure and account information, while payment service providers offer user-friendly UPI apps and interfaces. Users can initiate and receive payments using their UPI-linked bank accounts.

UPI has seen widespread adoption in India, with over 6 billion transactions recorded in 2023. The platform has become a popular choice for various transactions, including utility bill payments, e-commerce purchases, and peer-to-peer money transfers.

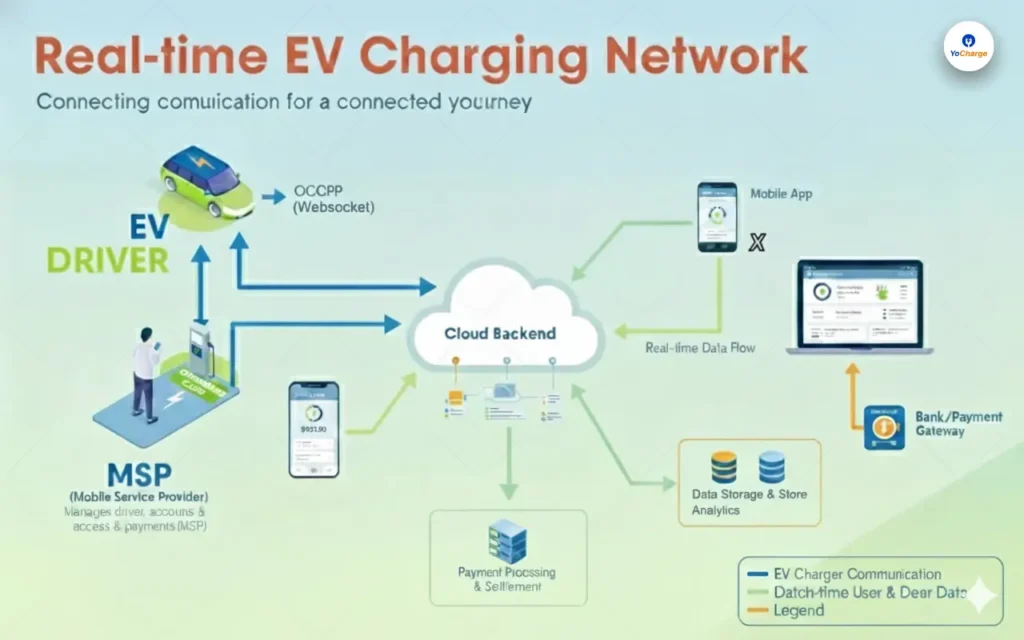

In the context of the electric vehicle (EV) industry, UPI is also being leveraged to facilitate seamless charging payments. EV drivers can use UPI-enabled apps to discover, access, and pay for charging services across different charging networks, providing a convenient and integrated payment experience.

What is UEI (Unified Energy Interface)?

Unified Energy Interface (UEI) is an open network designed for energy transactions, specifically targeting the electric vehicle (EV) charging ecosystem. UEI is based on the Beckn Protocol, which provides a standardized vocabulary and mechanism for different digital platforms to interact and transact with each other.

The primary purpose of UEI is to facilitate seamless payment and transaction interoperability within EV charging networks. It aims to address the interoperability challenges faced by EV drivers in accessing and paying for charging services across different charging networks.

Collaborative Effort Behind UEI

UEI has been developed through a collaborative effort by a consortium of energy companies, including ChargeZone, Pulse Energy, Kazam, Sheru, Trinity, and Turbo, among others. These companies have come together to create an alliance for an open energy network under the UEI initiative.

The alliance also includes leading public policy think tanks and research organizations, such as the Rocky Mountain Institute and the World Resources Institute, who are providing advisory support to advance the UEI initiative.

Core Functionalities Of UEI

The core functionalities of UEI are mentioned below:

- Facilitating Payments: UEI provides a unified payment interface, similar to UPI, that allows EV drivers to discover, access, and pay for charging services across different charging networks.

- Ensuring Interoperability: EUEI creates a standardized ecosystem where various digital platforms, such as charging point operators, energy companies, and payment service providers, can seamlessly interact and transact with each other.

Advantages of UEI for EV Drivers

The key advantage of UEI for EV drivers is the seamless charging experience it offers, regardless of the charging network provider. With UEI, EV drivers can access and pay for charging services at any participating charging station, without the need for multiple access cards or accounts. It simplifies the charging process and enhances the convenience for EV drivers.

Read Ahead

The Key Differences Between UPI vs UEI

| Aspect | UPI | UEI |

| Focus | UPI is a general digital payments platform that caters to a wide range of transactions across various sectors. | UEI is specifically designed for the electric vehicle (EV) charging ecosystem, facilitating seamless payments and interoperability within this domain. |

| Scope | UPI enables digital payments for a diverse set of use cases, including e-commerce, utility bills, peer-to-peer transfers, and more. | UEI’s scope is limited to the EV charging industry, providing a unified platform for EV drivers to discover, access, and pay for charging services across different networks. |

| Technical Approach | UPI is a banking protocol that facilitates the transfer of funds between bank accounts. | UEI is based on the Beckn Protocol, which is a transactional protocol that understands the business context and provides a mechanism for payments using UPI, credit cards, and other methods. |

| Participating Entities | UPI transactions involve banks, payment service providers (e.g., PhonePe, Google Pay, Paytm), and end-users. | UEI involves a collaborative effort by energy companies, including charging point operators, energy providers, and payment service providers, to create a unified ecosystem for EV charging. |

| Interoperability | UPI enables interoperability between different bank accounts and payment service providers, allowing seamless transactions. | UEI aims to create a standardized ecosystem where various digital platforms, such as charging point operators, energy companies, and payment service providers, can seamlessly interact and transact with each other. |

| User Experience | UPI provides a convenient, mobile-based payment experience for users, enabling real-time fund transfers. | UEI aims to offer a seamless charging experience for EV drivers, allowing them to access and pay for charging services across different networks using a unified platform. |

| Governance | UPI is governed by the National Payments Corporation of India (NPCI), a non-profit organization. | UEI is governed by a non-profit alliance of energy companies, with the goal of ensuring the protocol remains relevant and adaptable to market needs. |

Role of UPI vs UEI in EV Charging

Both UPI and UEI can play important roles in facilitating seamless EV charging payments in India.

| Aspect | UPI | UEI |

| Role in EV Charging | UPI can be integrated within the UEI ecosystem to provide a broader range of payment options for EV drivers, including credit cards, debit cards, and bank account-based transactions. | UEI is specifically designed to address the interoperability challenges in the EV charging ecosystem, providing a unified platform for EV drivers to discover, access, and pay for charging services across different networks. |

| Payment Options | The integration of UPI within UEI can offer EV drivers the convenience of using a wide variety of payment methods, including UPI, credit cards, and debit cards, for their charging transactions. | UEI’s primary focus is on facilitating seamless payments and transactions within the EV charging ecosystem, with the potential to integrate UPI and other payment methods to provide a comprehensive solution. |

| Streamlining EV Charging Experience | The combination of UPI’s widespread adoption and UEI’s specialized focus on the EV charging industry can significantly streamline the charging experience for EV drivers. Drivers can enjoy a seamless, hassle-free process of finding, accessing, and paying for charging services across different networks. | UEI’s ability to create a standardized and interoperable ecosystem for EV charging payments can greatly enhance the overall charging experience for drivers, eliminating the need for multiple access cards or accounts. |

| Potential Integration | The integration of UPI within the UEI ecosystem can leverage the strengths of both systems, providing EV drivers with a comprehensive and convenient payment solution for their charging needs. | UEI’s collaborative approach and focus on adaptability can enable the seamless integration of UPI and other payment methods, offering EV drivers a wide range of payment options within a unified platform. |

Conclusion

UPI and UEI differ in focus and scope. UPI is a general digital payments platform for various sectors, while UEI is designed specifically for the electric vehicle charging ecosystem. UPI caters to diverse transactions including e-commerce and peer-to-peer transfers, while UEI focuses on providing a unified platform for EV drivers to access and pay for charging services.

Efficient payment solutions are crucial for EV adoption, and integrating UPI into the UEI ecosystem can offer comprehensive payment options. The collaborative efforts behind the UEI initiative are poised to play a pivotal role in shaping the future of EV charging payments in India and supporting the country’s transition towards sustainable transportation.