Saudi Arabia’s transformation from the world’s largest oil producer to a pioneering hub of electric mobility represents one of the most significant strategic pivots in modern economic history. The Kingdom’s Vision 2030 initiative has positioned fleet electrification in Saudi Arabia as a cornerstone of its ambitious sustainability goals, driving unprecedented investments and regulatory changes that are reshaping the transportation landscape across the region.

Saudi Arabia ranks 23rd in Arthur D. Little’s 2023 Global Electric Mobility Readiness Index (GEMRIX), indicating significant progress and foundational efforts for electric vehicle (EV) adoption driven by its Vision 2030 goals.

Background

Saudi Arabia, the GCC’s largest automotive market with over half of all new regional vehicle sales, is rapidly advancing its green mobility agenda under Vision 2030. Through the Saudi Green Initiative launched in 2021, the Kingdom set a target for 30% of vehicles in Riyadh to be electric by 2030.

In line with this vision, Crown Prince Mohammed bin Salman unveiled CEER in 2022, the country’s first homegrown EV brand, created in partnership between PIF and Foxconn. CEER plans to produce 150,000 EVs annually by 2025. Complementing this, PIF acquired a 65% stake in Lucid Motors, which is building its first overseas plant in King Abdullah Economic City, with Saudi Arabia committed to purchasing 100,000 Lucid EVs over the next decade. Collectively, these moves aim to establish a domestic EV production capacity of 310,000 units by 2030.

To support adoption, Saudi Arabia is also investing heavily in charging infrastructure. Partnerships with firms like Electromin and ABB are expanding the public charging network, with Electromin already deploying 100 stations and offering free charging incentives. Further, the Public Investment Fund (PIF) and the Saudi Electricity Company have launched the new Electric Vehicle Infrastructure Company (EVIQ), which plans to establish 5,000 fast chargers across the Kingdom by 2030.

Much like Norway, Saudi Arabia is positioning itself to create a favorable ecosystem for EV manufacturing, imports, and ownership while lowering the total cost of operation for consumers.

Vision 2030: The Strategic Framework for Sustainable Mobility

Sustainability Goals and Emission Targets

Vision 2030, launched in 2016, establishes Saudi Arabia’s commitment to achieving net-zero carbon emissions by 2060 while diversifying its economy away from oil dependency. The initiative includes specific targets that directly drive electric mobility adoption:

- 30% of all vehicles in Riyadh to be electric by 2030.

- 50% reduction in carbon emissions in the capital city.

- 13% reduction in transport sector emissions compared to conventional vehicle fleets.

- 278 million tons of annual carbon emission reductions through the Saudi Green Initiative.

The National Transport and Logistics Strategy, launched in 2021, complements these goals by targeting 25% of goods transport vehicles to be autonomous (including electric) by 2030. This comprehensive approach demonstrates the Kingdom’s commitment to transforming both passenger and commercial fleet segments.

Economic Diversification Through Electrification

The economic rationale behind fleet electrification extends beyond environmental considerations. The Kingdom has allocated over USD 50 billion in EV manufacturing and infrastructure development over the next decade, with expectations to attract USD 150 million in foreign direct investment and create approximately 30,000 jobs. The Public Investment Fund (PIF), with assets totaling USD 700 billion, has committed USD 39 billion specifically for the electric mobility ecosystem, including USD 18 billion for manufacturing, USD 9 billion for battery ecosystem development, and USD 12 billion for chips and components.

Giga-Projects as Electric Mobility Catalysts

NEOM: The Future of Sustainable Transportation

NEOM, Saudi Arabia’s flagship USD 500 billion smart city project, serves as a living laboratory for advanced electric mobility solutions. The project has already begun implementing cutting-edge transportation technologies:

- Eight Swedish Candela P-12 electric hydrofoil passenger ships for waterborne transport, with delivery beginning in 2025

- Hyundai hydrogen bus testing programs as part of clean transport initiatives

- Comprehensive autonomous and electric vehicle integration throughout the city’s transportation network

NEOM’s scale demonstrates the Kingdom’s commitment to next-generation mobility. The project alone is estimated to require around 20,000 construction vehicles at peak construction, creating immediate demand for electric and hybrid commercial vehicles.

Red Sea Global: Setting Industry Standards

Red Sea Global (RSG), the developer behind The Red Sea and AMAALA projects, has achieved several industry firsts in fleet electrification:

- Saudi Arabia’s first-ever fleet of carbon-neutral electric buses

- Fleet encompassing two vehicle types – smaller vehicles with 250km range and larger buses with 350km range when fully charged

- Target of carbon neutrality by 2030 with comprehensive electric transport networks

These giga-projects serve as proof-of-concept deployments that demonstrate the viability of large-scale fleet electrification in the challenging Arabian climate, providing valuable data and experience for broader national deployment.

Government Policies Accelerating Electrification of Fleets in Saudi Arabia

Financial Incentives and Regulatory Support

The Saudi government has implemented a comprehensive incentive structure to accelerate fleet adoption: Subsidies covering up to 50% of licensing fees for electric vehicles 24% licensing fee subsidies for hybrid vehicles Customs duty exemptions for imported electric vehicles Road tax exemptions and reduced VAT rates Free parking in designated areas for electric vehicles

Charging Infrastructure Development Policies

The government’s infrastructure strategy addresses the critical challenge of charging availability:

- EVIQ (Electric Vehicle Infrastructure Company) established as a joint venture between PIF and Saudi Electricity Company

- 5,000+ fast chargers planned across 1,000+ locations by 2030.

- Strategic highway charging corridor development in Saudi Arabia including Riyadh-Qassim, Riyadh-Dammam, and Mecca-Madinah routes.

Status of Fleet Electrification in Saudi Arabia in 2025

Overall Fleet Composition

Saudi Arabia’s vehicle fleet has experienced substantial growth, reflecting the country’s economic expansion and population growth:

- Total vehicle fleet: 6.6 million vehicles as of 2015, projected to reach 14.5 million by 2035

- Fleet composition: 75% passenger vehicles, 25% commercial vehicles

- Average fleet age: 6-7 years, relatively young compared to global standards

- Geographic concentration: 70% of fleet located in Riyadh, Jeddah, and Eastern Province

Commercial Vehicle Market Data

The commercial vehicle sector, critical for fleet electrification in Saudi Arabia, shows strong growth potential:

- 2025 projected sales: 141,900 commercial vehicles

- Market size: USD 7.24 billion in 2025, projected to reach USD 9.71 billion by 2030 (6.05% CAGR)

- Light commercial vehicles dominate with 41.33% market share Electric and hybrid commercial vehicles growing at 8.76% CAGR through 2030.

Current Statistics of Fleet Electrification in Saudi Arabia

The electric vehicle market, while starting from a small base, demonstrates explosive growth:

- EV registrations increased 425% between 2021-2023, from 375 to over 12,000 vehicles

- Current EV market share: Just over 1% of total vehicle sales

- Consumer interest: 65% of Saudi citizens express interest in purchasing an EV within three years

- Fleet customer adoption: Corporate sector expected to add 50,000 EVs by 2025.

Fleet Electrification in Saudi Arabia: Projections

Based on PWC analysis and government targets, fleet electrification is expected to accelerate significantly:

- 2025: 15% of new vehicle sales in major cities to be electric

- 2030: 30% of all vehicles in Riyadh to be electric

- 2035: Over 60% of new vehicle sales projected to be electric

- Total EVs on road by 2035: Over 3 million vehicles

Commercial Fleet Specific Projections

Commercial fleet electrification in Saudi Arabia shows particularly strong growth potential:

- Current commercial EV adoption: Minimal, but growing at 8.76% CAGR

- Public transport: Electric buses operational in 4+ cities with expansion planned

- Corporate fleets: Expected to drive significant adoption with fleet discounts making EVs cost-competitive.

Challenges to 2030 Vision

Infrastructure Challenges

The rapid growth in EV adoption faces infrastructure constraints:

- Current charging infrastructure: ~285 public charging points by end of 2023

- Required infrastructure by 2035: 160,000 charging stations to support 3.3 million EVs

- Investment gap: Substantial infrastructure investment required to meet demand projections

Climate Considerations

Saudi Arabia’s extreme climate poses unique challenges:

- High temperature impact: 23% range reduction at 40°C compared to optimal 20°C performance

- Battery performance degradation in extreme heat requires advanced thermal management systems

- Charging speed reduction during high-temperature conditions.

Battery Supply Chain

- To meet its manufacturing goals, the Kingdom aims to produce 187,500 EV battery units annually, each with a capacity of 80 kWh, totaling 15 GWh.

- Two-thirds of these batteries will need to be imported to meet the production targets.

Saudi Arabia is securing US$9 billion for EV batteries, metals, and minerals, with major investments from the EV Metals (US$900 mn)13 and Ivanhoe Electric (US$126.4mn). The Kingdom must secure a stable supply of critical EV battery minerals and transition to cleaner energy sources to power the growing number of EVs. (ref)

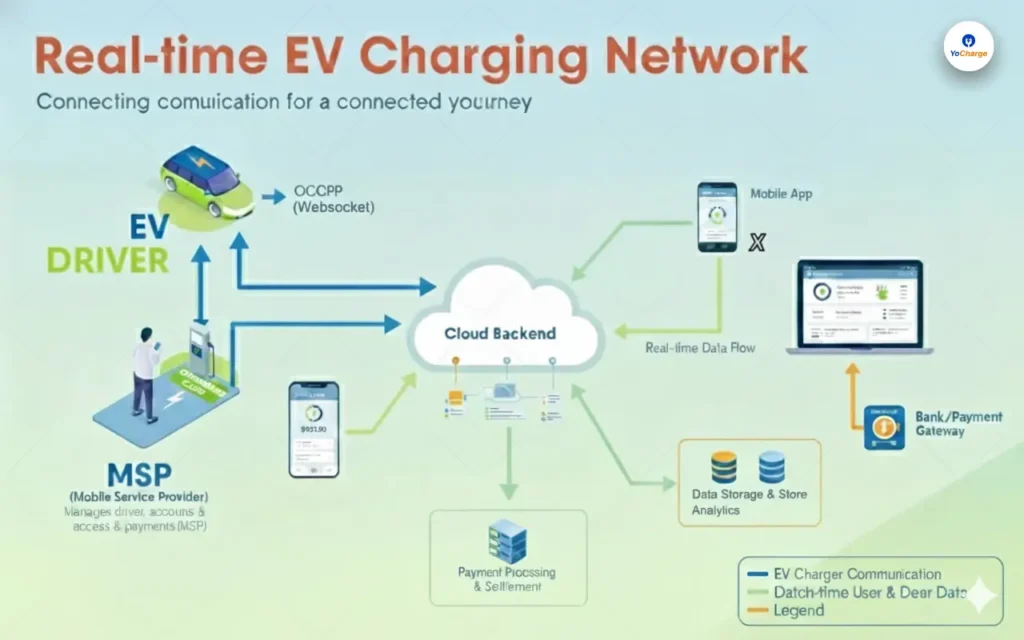

How YoCharge is Enabling the Transition

YoCharge, as a global EV Charging & Energy Management SaaS, is already active in Saudi Arabia through partnerships with multiple CPOs and Fleet Companies. This positions YoCharge as a strategic enabler for fleet electrification in Saudi Arabia under Vision 2030. Here’s how YoCharge is bridging the gap:

- Unified Charging Cloud

- YoCharge integrates multiple Saudi CPO networks into a single platform.

- Fleet operators and Uber-like ride-hailing partners only need one API integration to access chargers across the Kingdom.

- Smart Fleet Management Through its YoMobility Fleet Management System, YoCharge provides fleets with:

- Smart routing to available chargers.

- Reservation and queue management to reduce downtime.

- SOC-based (State of Charge) dynamic planning.

- Energy Contracts & Billing

- YoCharge manages energy transactions, invoicing, and reconciliation between fleets and CPOs.

- Fleets get transparent, predictable charging costs without negotiating with multiple providers.

- High-Uptime Network

- By proactively monitoring uptime of all integrated CPO partners, YoCharge ensures drivers spend less time searching for chargers and more time on the road.

Strategic Impact on Fleet Electrification in Saudi Arabia:

- Compliance with Vision 2030 mandates – enabling fleets to meet electrification targets seamlessly.

- Cost savings – optimized charging schedules and simplified billing reduce operational overhead.

- Driver satisfaction – reduced downtime and easy access to chargers improve driver retention.

- Data-driven operations – fleets gain access to usage analytics, charging patterns, and energy cost insights.

With with multiple CPOs already live in Saudi Arabia, YoCharge is expanding its network to cover key logistics hubs, airports, and urban centers. By offering plug-and-play solutions for electric fleets, YoCharge is ensuring that electrification in Saudi Arabia moves from policy to practice — enabling Vision 2030’s green mobility ambitions.

Our cutting-edge Energy Theft Detection system leverages advanced Machine Learning and AI technologies to protect your revenue and optimize grid operations.

The Path Forward

Fleet Electrification in Saudi Arabia under Vision 2030 represents a comprehensive transformation of the Kingdom’s transportation sector. With over USD 50 billion in committed investments, ambitious manufacturing targets, and supportive government policies, the Kingdom is positioning itself as a regional leader in electric mobility.

The convergence of economic diversification goals, environmental sustainability targets, and technological innovation through projects like NEOM and Red Sea Global creates a unique ecosystem for success of fleet electrification in Saudi Arabia. While challenges remain in infrastructure development and climate adaptation, the Kingdom’s substantial financial resources and strategic partnerships with global automotive leaders provide a strong foundation for achieving its 2030 targets.

The transformation from a nation of 375 electric vehicles in 2021 to a projected 3+ million EVs by 2035 represents one of the most ambitious and rapid fleet electrification programs globally, demonstrating Saudi Arabia’s commitment to redefining its role in the global energy and mobility landscape.