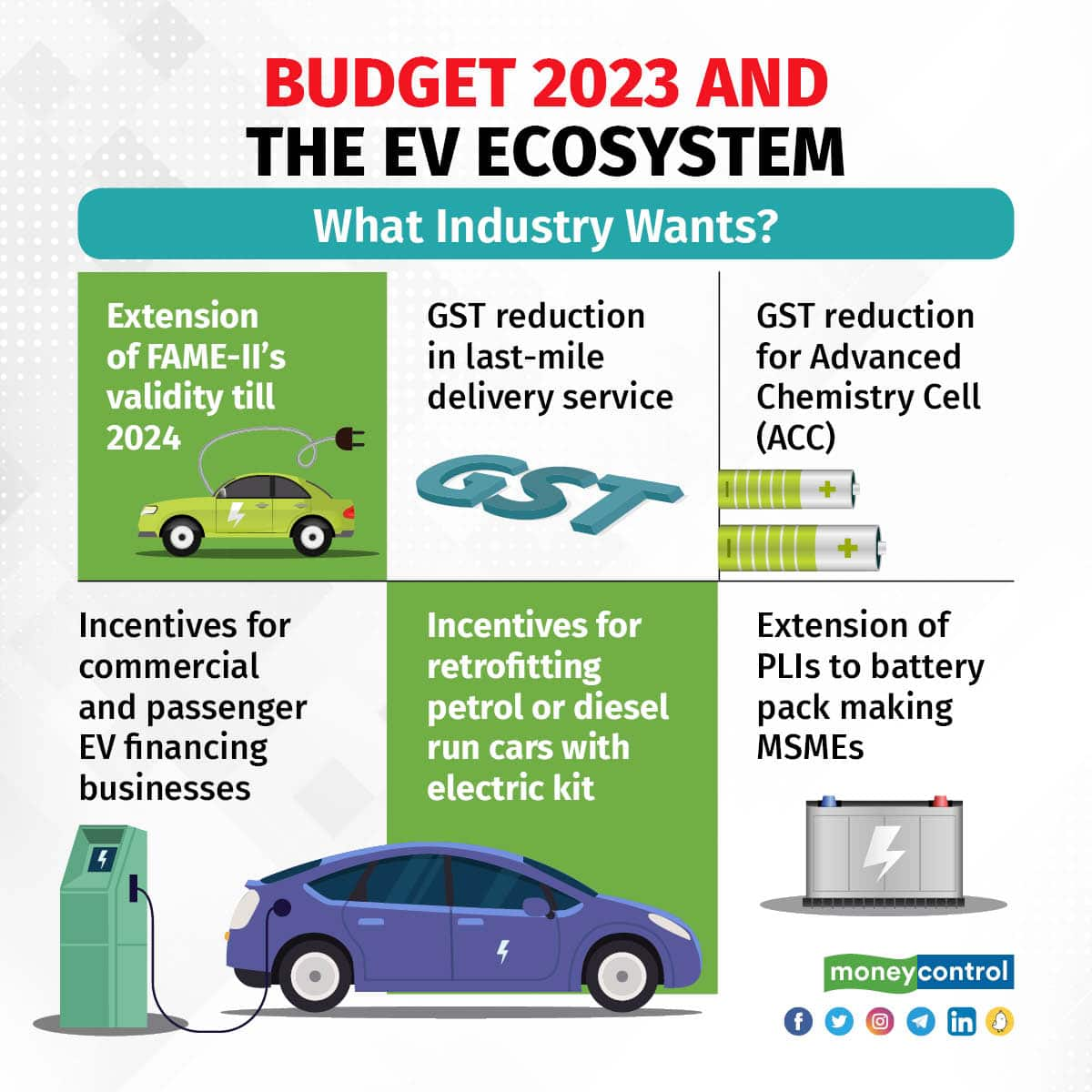

India’s expanding EV industry is awaiting the upcoming 2023 budget, which will be delivered by Union Finance Minister Nirmala Sitharaman on or before February 1, 2023. A number of benefits, including the continuation of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) scheme beyond 2024 and a reduction in GST, are expected by the EV industry (including ancillaries).

Expectation of EV Market from 2023 Budget

SUN Mobility, based in Bengaluru, suddenly stated its goal of selling over 10,000 electric two-wheelers (E2W) in India by 2023. “The EV industry expects the GST on ACC (Advanced Chemistry Cell) batteries to be reduced and brought on par with EVs (5 percent),” said Chetan Maini, Co-Founder and Chairman, SUN Mobility.

The use of electric two-wheelers (E2W) is expanding quickly, and India is expected to have one of the largest two-wheeler markets worldwide. A total of 18,47,208 two-wheelers were sold in India in November 2022; 76,438 of those (4.1%) were E2Ws. According to Zypp Electric, the GST on last-mile delivery services needs to be decreased in order to increase the demand for electric two wheelers.

“My biggest pain point right now is that the use of EVs is picking up in the last-mile delivery segment — like Zomato, Bigbasket, Amazon, etc. — but we have a GST of 18 percent with no incentives,” Said Akash Gupta, Co-Founder, and CEO, Zypp. “I can make the entire last-mile delivery industry go electric in the next two years. But we are finding it difficult to scale up. We expect the GST to be brought down to zero in the coming budget,” he added.

The promotion of electric vehicles was indeed a key focus of the 2022–2023 budget. Under FAME-II, cash incentives worth Rs 10,000 crore were given to increase demand. PLI (production-linked incentive) programs of Rs 44,038 crore, including for ACC batteries, had been announced to support supplies.

“India needs to work on developing the commercial EV segment as well” said Inderveer Singh, Founder, and CEO, EVage, a commercial EV startup. “The government needs to consider commercial EV financing to enable quick adoption in the E4W category. Instead of subsidies, we need lower interest rates for EV financing and standardized residual battery value calculation (what is this & how does it impact the industry). Fleet owners will significantly benefit from the clearance of these hurdles,” Singh added.

The market for electric light commercial vehicles, which is currently between 3,50,000 and 400,000 units, is expected to expand by 7 to 10 percent a year until 2025. This market is primarily driven by logistics and e-commerce companies, who are electrifying their first and last-mile fleets to cut costs and to comply with ESG standards.

The founder of Ola Electric, Bhavish Aggarwal, told the media that the company would concentrate on producing motorbikes, releasing lithium-ion batteries, and exploring and discovering into the commercial vehicle (CV) market in 2023. “Our investment focus for 2023 will be on light commercial vehicles (LCV) and motorcycles, as well as lithium-ion cells,” he had said.