EV Charger Financing in India: India’s electric vehicle market is growing fast. EV sales crossed one million units in FY 2024–25. Now, the focus is shifting to building enough charging stations to support this growth.

The Ministry of Power estimates India will need at least 2.6 million public and semi-public charging points by 2030. But there is a challenge and that is not the technology but the cost of an EV charger.

A fast DC charger can cost more than ₹10 lakh. Even a smart 7 kW AC home charger can cost ₹70,000 with installation. This is where EV Charger Financing in India becomes important. It helps homeowners and businesses install chargers without spending a huge amount upfront.

Why Does EV Charger Financing is Important?

Electric vehicles are the future. BloombergNEF says that by 2040, 57% of new car sales globally will be electric. But this growth depends on having enough charging stations.

That is why EV Charger Financing is so helpful. It lets you buy a charger now and pay in small amounts later. This keeps your cash flow safe while supporting long-term growth.

Cost of EV Chargers in India

| Charging Type | Hardware Cost | Installation Cost | Yearly Maintenance |

|---|---|---|---|

| Home AC (3.3–7 kW) | ₹40,000–₹60,000 | ₹10,000–₹25,000 | Minimal |

| Workplace AC (7–22 kW) | ₹60,000–₹1,00,000 | ₹30,000–₹50,000 | ₹5,000–₹10,000 |

| Public DC Fast (30–60 kW) | ₹6–10 lakh | ₹2–4 lakh | ₹80,000–₹1.2 lakh |

| Highway DC Ultra-Fast (120 kW+) | ₹18–40 lakh | ₹5–8 lakh | ₹2–3 lakh |

Also Read: Hardware Agnostic EV Charging: Why Does It Matters for Your Business?

Options of EV Charger Financing in India

There are multiple ways to finance EV chargers in India. Each option suits a different type of buyer or business based on needs, ticket size, and repayment capacity.

Loans from Banks and NBFCs

- Business Term Loans: Green-focused lenders like IREDA or TATA Capital offer loans that cover 70% to 80% of the project cost. Interest rates range from 9% to 12%, and you can repay in 3 to 7 years.

- Personal Loans for Homes: Some Indian fintech firms like CASHe and Bajaj Finserv give unsecured loans of up to ₹5 lakh. These are perfect for home chargers and get approved fast.

OEM and Vendor Financing

- Global brands like Kempower provide all-in-one financing. Their plans include hardware, installation, and maintenance for a monthly fee.

- Indian companies such as Delta and Exicom offer lease-to-own plans starting from ₹15,000 per month for a 30 kW charger.

These options reduce paperwork and make financing easier.

Leasing and Subscription Models

- Leasing turns big investments into small monthly payments. This helps companies manage their cash better.

- Sun Mobility’s Battery-as-a-Service model is a great example. Similar models are coming for chargers too. You can pay based on usage while the financier owns the charger.

Government Schemes and Subsidies

- SIDBI’s EV4ECO Program: This provides soft loans to MSMEs at 7% to 8% interest for installing chargers.

- State Incentives: Some states like Tamil Nadu and Telangana offer refunds up to 25% of equipment costs.

- Loan Guarantees: Similar to the US model, India is planning to back private loans with guarantees in rural areas.

Public-Private Partnerships (PPP)

- India’s highways are also getting attention. The National Highways Authority of India has offered PPP bids for 600 highway charging stations. The government pays back the cost over 10 years, while the private investor puts in 40%.

Best EV Charger Financing Structures for Different Buyers

| Stakeholder | Financing Type | Reason |

|---|---|---|

| Homeowner | Personal loan or EMI | Small cost, regular usage |

| Fleet operator | Leasing | Keeps balance sheet light |

| Mall owner | Vendor finance or PPP | Matches revenue with usage |

| Highway Operator | Project finance + annuity | Handles high investment and slow return |

Other EV Charger Financing Sources

Beyond loans and leases, there are innovative funding options like green bonds, mezzanine debt, and carbon credit revenue. These options help bridge capital gaps and attract ESG-focused investors.

- Senior Debt: Lenders provide up to 70% of the project cost. The loan is secured with the charger as collateral.

- Mezzanine Debt: Covers the remaining cost at higher interest.

- Green Bonds: Many Indian power companies issue these to attract ESG investors.

- Carbon Credits: Chargers powered by solar can earn ₹600–₹900 per year through carbon credit sales.

Steps to Get EV Charger Financing in India

EV charger financing involves careful planning, proper documentation, and the right funding source. You should follow the below steps to secure financing without disrupting your cash flow.

- Check the Location and Demand: Use traffic data and EV ownership statistics to choose a location. Make sure there is enough power nearby.

- Create a Business Plan: Predict usage, show potential earnings from ads or cafés nearby, and explain how you will manage risks.

- Prepare All Documents: Include land ownership papers, power company approvals, and vendor estimates.

- Pick the Right Financing: Compare options based on interest rates and repayment terms. Also check tax benefits.

- Sign and Monitor: Make sure your service agreement covers maintenance and performance. Install meters to track energy use.

Future Trends in EV Charger Financing in India

India’s EV Charger Financing in India is poised to evolve with innovative trends. Expect more green bonds and sustainable finance tools to fund large charging networks, lowering borrowing costs thanks to investor appetite for clean infrastructure.

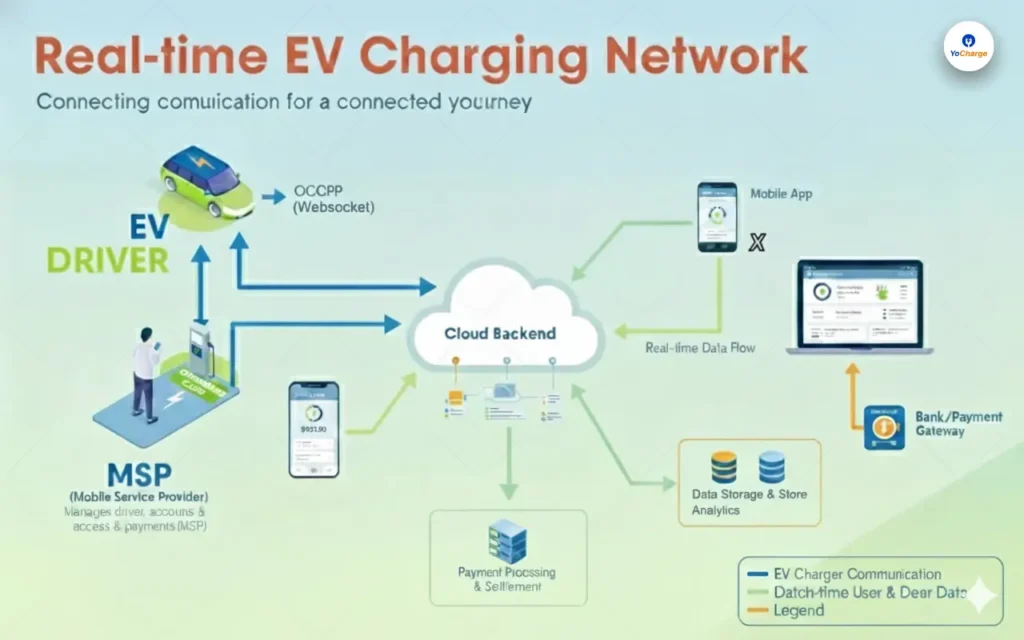

Pay‑per‑use and subscription models like Charging‑as‑a‑Service (CaaS) will become mainstream, converting high upfront costs into manageable operating expenses. Intelligent charging leveraging IoT, AI, and vehicle‑to‑grid (V2G) integration will unlock flexible pricing and grid support.

Additionally, crowdfunding and fintech-led micro‑loans promise to democratise access for underserved rural and SME users. These trends signal a vibrant future for EV Charger Financing in India.

Who Can Apply for EV Charger Financing in India?

EV Charger Financing in India is open to a wide range of individuals and businesses. Check out who can benefit:

Homeowners and Individual Car Owners

- Residential individuals installing home AC chargers (3 kW to 7 kW) can avail personal loans or unsecured EMIs from fintech lenders such as Bajaj Finserv, CASHe, or Tata Capital.

- Some banks, including HDFC and SBI, provide green loans or concessional financing to individual borrowers setting up EV chargers at home or in private parking spaces.

Micro, Small & Medium Enterprises (MSMEs)

- MSMEs running fleets, small charging outlets, or roadside services can apply for term loans through banks or NBFCs. For example, SBI‑Statiq offers ₹10 lakh to ₹5 crore loans, with a 2% interest subvention for loans up to ₹2 crore under CGTMSE.

- SIDBI and green‑energy NBFCs like IREDA also support MSMEs with soft loans or credit lines for charging infrastructure.

Commercial Properties and Fleet Operators

- Hotels, restaurants, offices, and malls seeking to install EV chargers can use vendor financing, leasing models, or commercial loans.

- Financing may cover equipment, installation, and operation. Tata Power’s EV Mitra scheme, backed by SBI, enables property owners and fuel stations to apply for loans, subsidies, and fast-track regulatory clearances.

Fuel Stations and Public Charging Point Operators

- Petroleum pumps and designated charging point operators can access public‑scale charging station loans via government‑backed schemes or green financing from banks/NBFCs.

- Projects under FAME‑II for rapid charging infrastructure can claim up to 50% subsidy on depot chargers and reduced GST at 5% on chargers.

State and Local Government Projects / Aggregators

- Local bodies and PPP concessionaires working to install chargers along highways, bus depots, or rural regions can leverage government annuities, grants, and partial‑risk guarantees.

- Multilateral bank collaborations under discussion via NITI Aayog aim to support rural charging corridors.

Also Read: How Public Charging Networks Are Supporting EV Growth?

Things to Keep in Mind

- Some states offer special electricity rates for EV charging, which can be ₹6 to ₹7 per kWh. Lock these rates in early.

- Chargers above 50 kW still attract 20% import duty. Buying locally assembled ones can cut costs.

- Public transport depots can claim 50% subsidy under the FAME-II scheme.

- Pairing chargers with battery storage can lower electricity bills by up to 30%.

- Some cities waive parking fees for EV charging points. Include these benefits in your financial plan.

Final Thoughts: EV Charger Financing in India

EV Charger Financing in India is now more accessible than ever. With many loans, leasing options, vendor programs, and government schemes available, buyers can easily install charging stations without stress.

Whether you are a homeowner, fleet operator, or real estate developer, the right financing solution can help you support India’s electric future without draining your funds.

Take the next step today. Choose the best EV Charger Financing in India and power up your EV journey with ease.