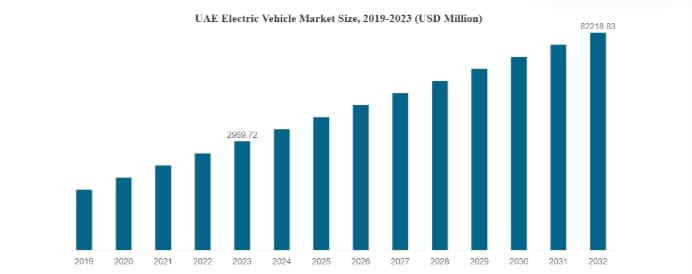

The UAE electric vehicle market was valued at $2,969.72 million in 2023. By 2032, it is expected to reach $82,218 million, growing at a CAGR of 45.84% from 2024 to 2032. The government aims to have 42,000 EVs on the road by 2030 and has already converted 20% of its government agency cars to electric. The UAE ranks among the top 10 worldwide for electric mobility readiness.

The UAE has heavily invested in charging infrastructure, increasing the number of stations by 60% over three years to 800. Abu Dhabi plans to add 70,000 charging points by 2030. Authorities and private companies are improving charging technology to reduce time. Consumer demand for EVs is rising in the UAE EV market, with 30% of residents considering buying an electric car due to green transportation aspirations.

Passenger vehicles dominate the UAE electric vehicle market, holding a 95% share, with rental companies also adopting EVs. Macroeconomic factors, such as energy security concerns and climate change mitigation efforts, drive growth. Rising fuel prices and the need for power savings boost EV demand. The booming tourism industry increases the demand for sustainable travel options. Dubai leads the market, with Sharjah following with well-placed charging points along highways.

UAE Electric Vehicle Market Dynamics

The expanding affordability and cost-effectiveness of electric vehicles (EVs) drive the UAE electric vehicle market. EVs have become cheaper to buy and operate, making them accessible to more people. The UAE ranks as the fourth cheapest country for charging an EV, with consumers saving 88% on fuel costs by switching to electricity. This significant cost reduction boosts demand for EVs.

Over the past five years, EV prices have dropped, transforming the UAE electric vehicle market. For example, a Tesla Model 3 costs $0.34 per km in Dubai, making it comparable to traditional petrol cars. Running an electric car is now 40% cheaper than a similar-sized petrol vehicle in the UAE.

Government subsidies and incentives further reduce costs for buyers. EV owners in the UAE electric vehicle market enjoy benefits like free parking and toll gate exemptions. In Dubai, authorities waived charging tariffs at public stations until the end of 2023. These incentives, combined with the lower running costs of EVs, make them attractive to consumers.

Falling battery costs have also lowered purchase prices. Batteries, once the most expensive EV component, have become cheaper due to mass production and advances in cell chemistry. From 2010 to last year, average battery pack prices declined by 89% in the UAE electric vehicle market.

Current Trends in the UAE Electric Vehicle Market

The UAE electric vehicle market is rapidly expanding with significant investments in charging infrastructure and supportive government policies. Technological innovations and private sector involvement further drive the growth and accessibility of EVs. The major trends in the UAE electric vehicle market are as follows:

Booming EV Charging Infrastructure in the UAE

The UAE EV charging infrastructure is booming, with 800 stations by 2023, a 60% rise in three years. Government support fuels this growth, led by Dubai’s deployment of over 300 stations through DEWA. The UAE offers both private and public charging facilities at malls, hotels, and homes.

Ambitious Goals and Government Support

The UAE electric vehicle market aims for 42,000 EVs on its roads by 2030 and converting one-fifth of official vehicles to electric. Dubai’s Green Charger program offers free use until 2023, and Abu Dhabi provides free parking and toll exemptions for EV owners. Private enterprises, like Majid Al Futtaim, are installing chargers, while DEWA and ADNOC are expanding the network.

Technological Innovations

Technology plays a vital role in the growth of the UAE electric vehicle market. DEWA trialed solar-powered charging stations in 2020. Faster charging solutions are being researched through partnerships like SRTIP. The UAE’s commitment from the government and businesses ensures a strong EV market.

Optimistic Outlook

Abu Dhabi plans for 70,000 charging points by 2030. The UAE is strategically positioned to become a global leader in clean energy transportation systems. This region, rich in natural resources and strategic location, is poised for international market leadership in electric vehicles.

Challenge of the UAE Electric Vehicle Market

The UAE EV market is growing continuously with the support of governmental policies and people’s choice of electric vehicles. Instead of this growth, the UAE EV market is facing challenges at various points including:

- Limited Dealer Networks: Only 10% of car dealerships sell electric vehicles, restricting access and consumer knowledge.

- Shortage of Trained Salespeople: Buyers struggle to find knowledgeable salespeople, deterring 45% of potential buyers.

- Insufficient Service Networks: Only 15% of repair shops have trained technicians, causing longer wait times for EV repairs.

- Longer Repair Times: EV repair wait times average seven days, compared to two days for regular cars.

- High Diagnostic Equipment Costs: Small-scale repairs require $5,000-$50,000 worth of diagnostic equipment, limiting its use.

- Limited Diagnostic Centers: Only one in five EV owners has a diagnostic center within a 20km radius.

- Few Trained Technicians: Only 500 technicians are currently trained; the government aims to train 5,000 within five years.

- Limited EV Models: Few models from different brands are available, reducing consumer choice.

- Investment Needs: Astute Analytica estimates that $200 million is needed to develop dealer networks.

- Potential Adoption Increase: A well-developed network could boost EV adoption rates by 25% over the next five years.

As We Conclude

The UAE electric vehicle market is rapidly expanding due to affordability, government support, and technological advancements. Charging infrastructure has grown significantly, with plans for further expansion to meet ambitious EV adoption goals.

Government incentives and private sector involvement make EVs increasingly attractive to consumers. However, developing a robust dealer and maintenance network remains a major challenge. Limited dealerships and trained technicians restrict consumer access and knowledge, hindering market growth.

Improving the service network is crucial, as current repair wait times and costs are high. More trained technicians and accessible diagnostic centers are needed to support EV owners. Investing $200 million in dealership networks could boost EV adoption rates by 25% in five years.

The UAE is strategically positioned to become a global leader in clean energy transportation, with continued government and business commitment. Addressing dealer and maintenance challenges will ensure sustained growth and consumer confidence in the UAE’s electric vehicle market.